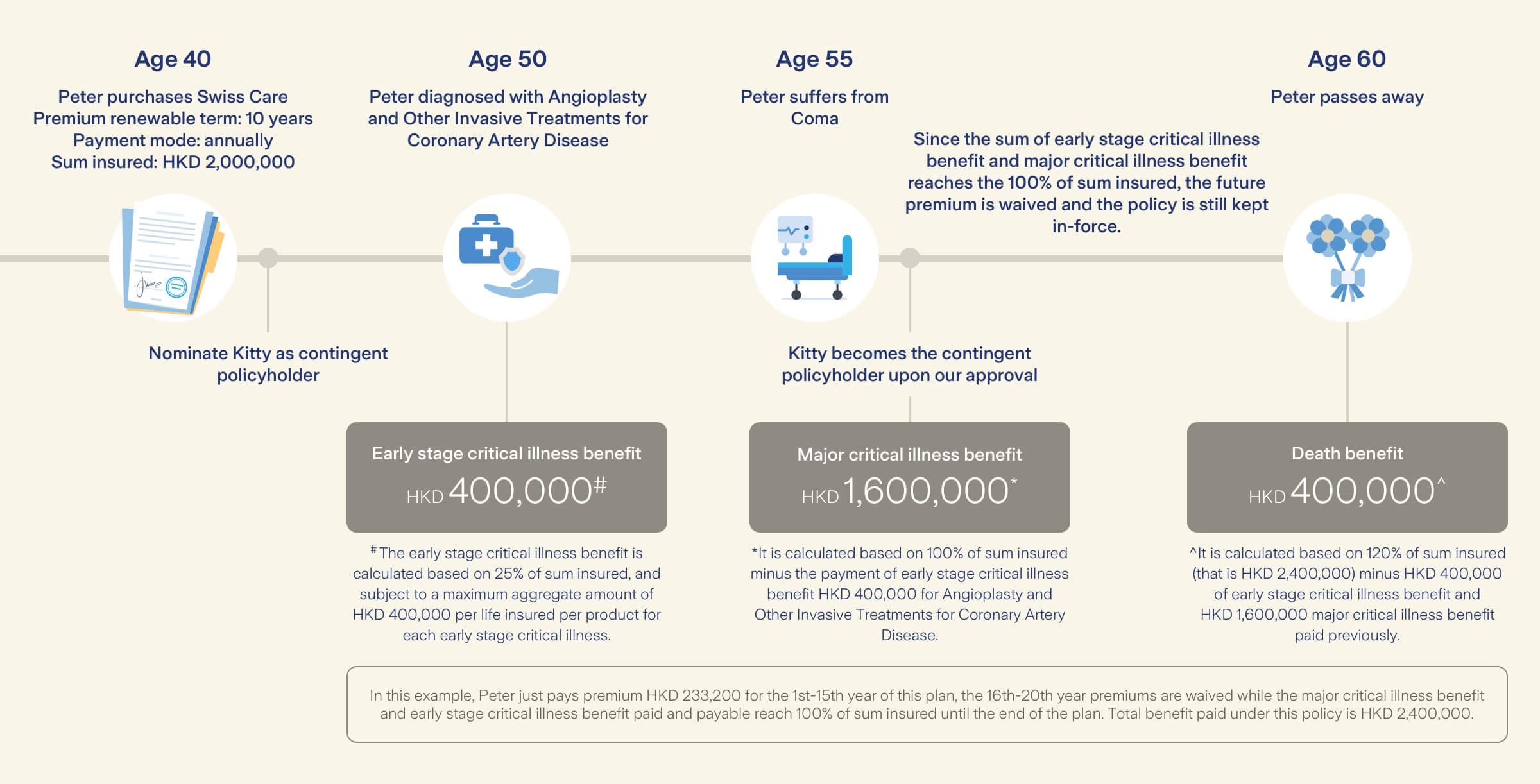

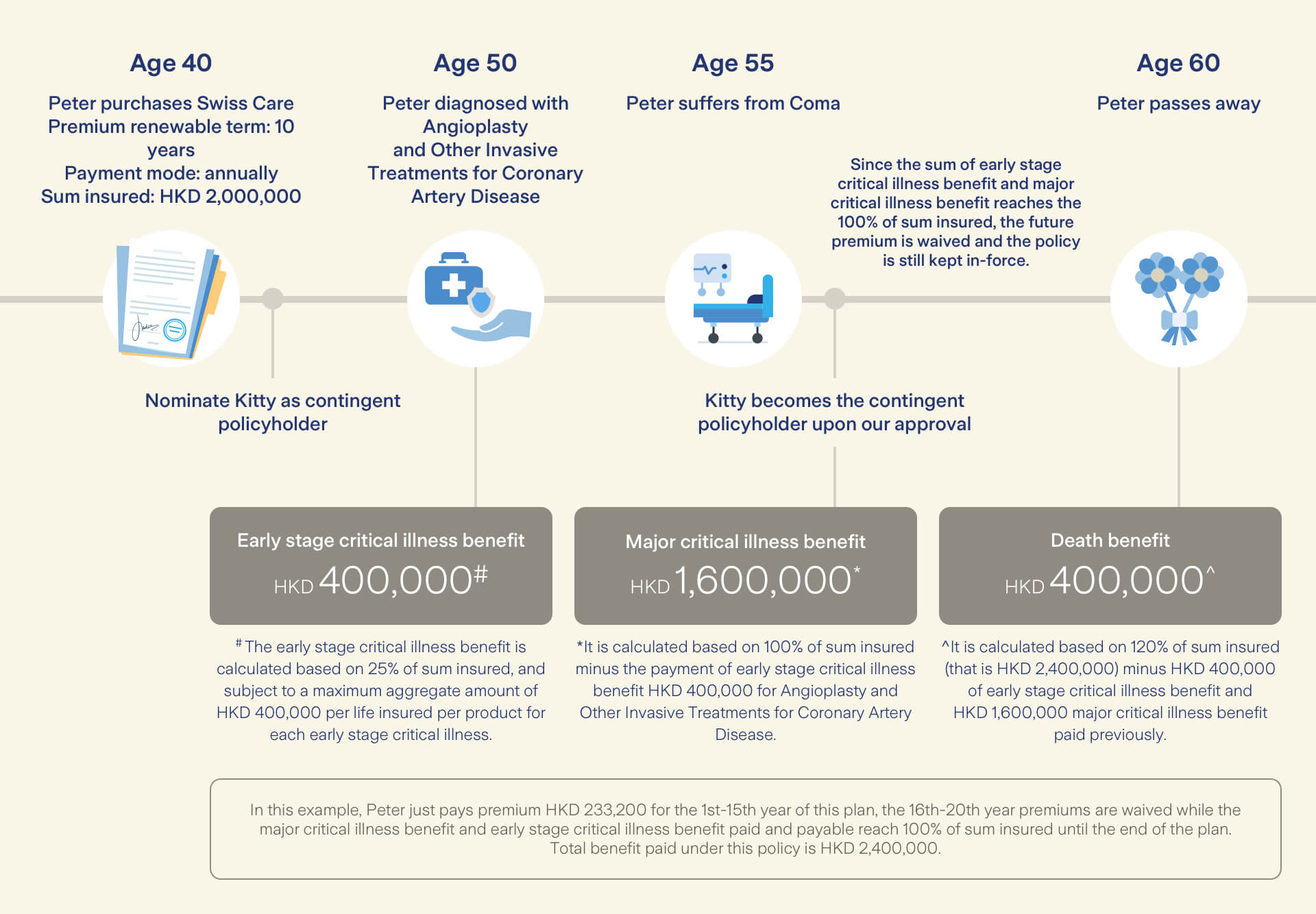

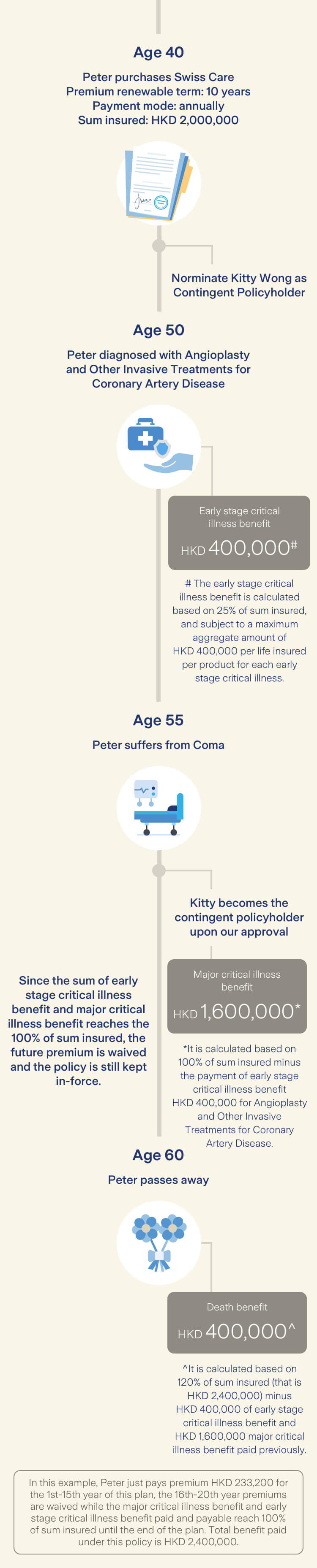

Age 40/Non-smoker/Married with no children

Peter is a young professional, he would like to have critical illness protection with affordable premium to protect himself and his wife. So Peter purchases Swiss Care Critical Illness Insurance Plan and nominates his wife Kitty as the contingent policyholder.

- The above example is hypothetical and is for illustrative purpose only.

- The age referred to in above example is the age of the life insured on his next birthday.

- This premium assumes that the premium will not increase within 15 policy year (except the renewal premium increase on attained age changed on 11th -15th policy year) and not included levy.

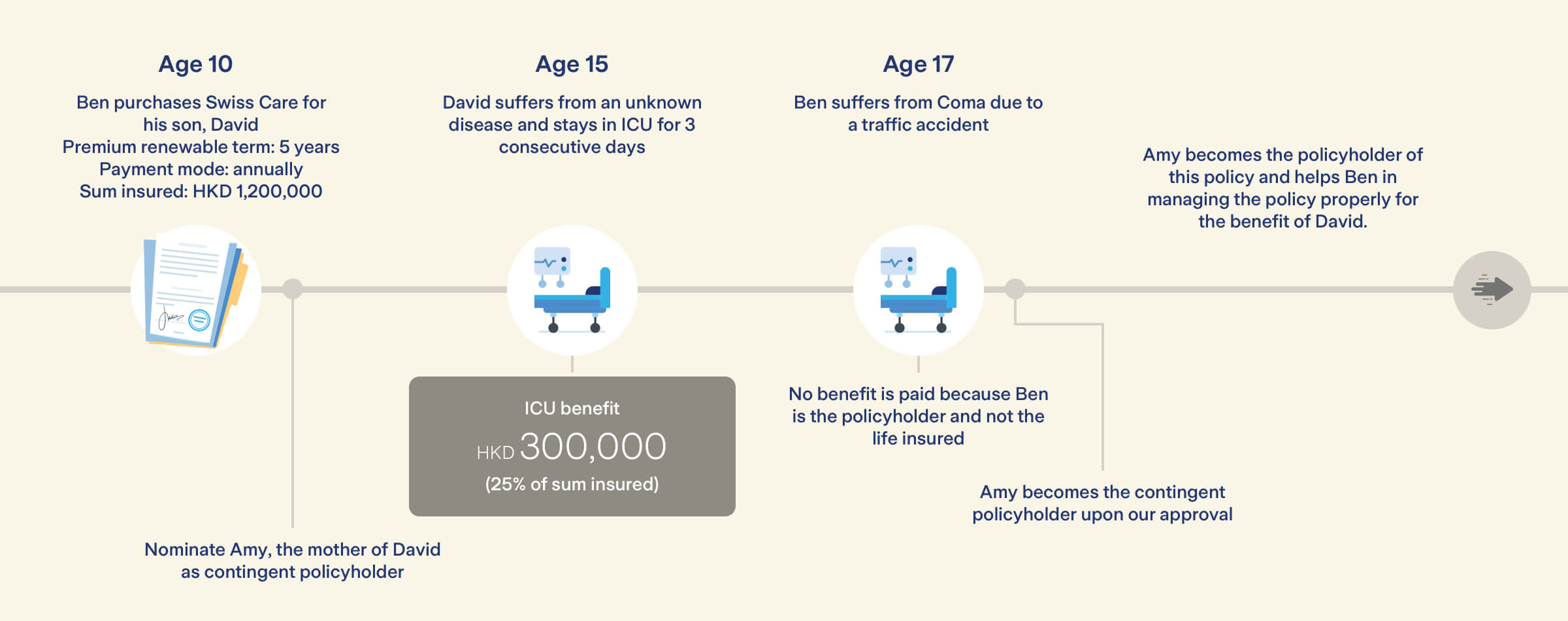

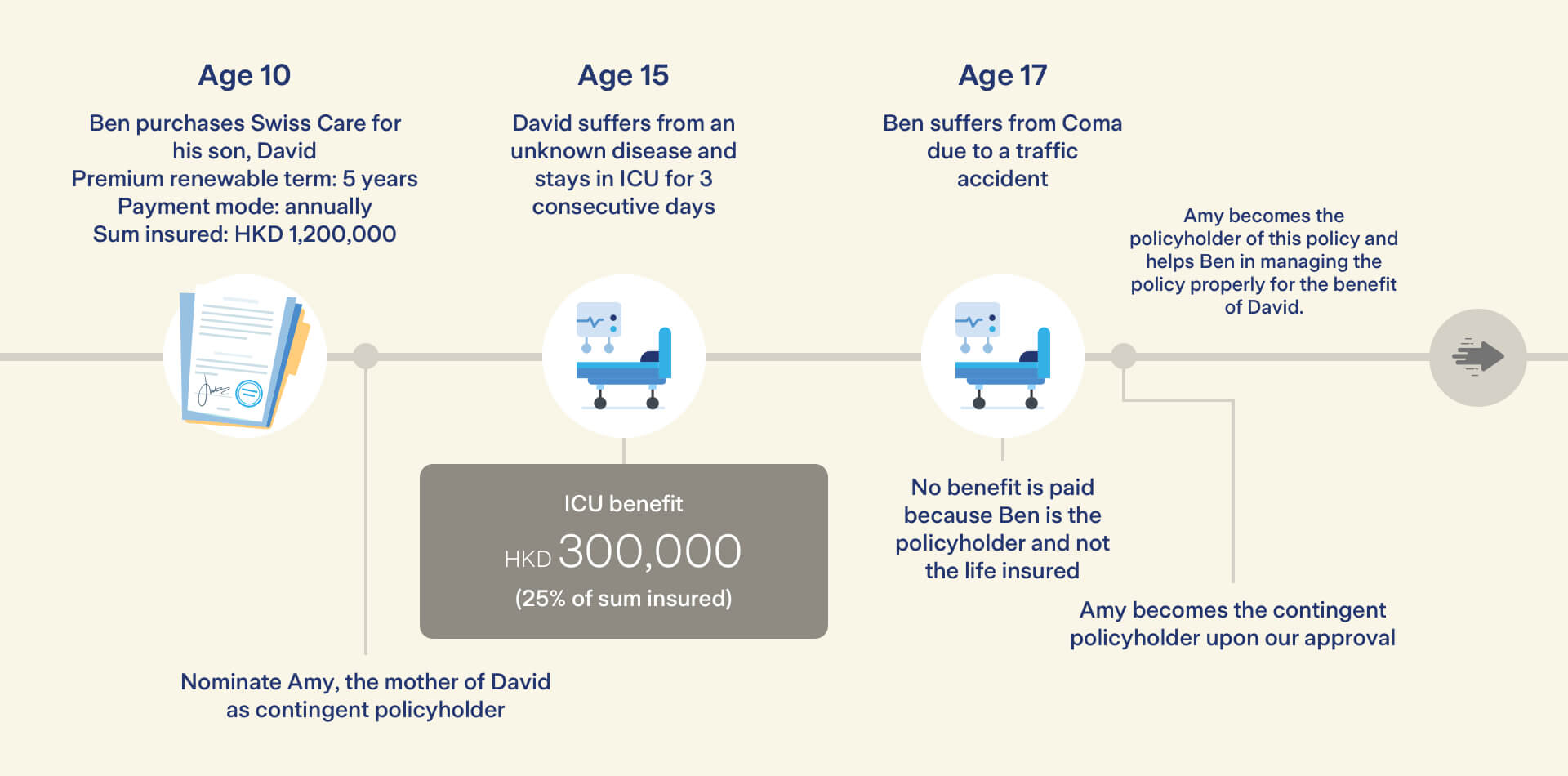

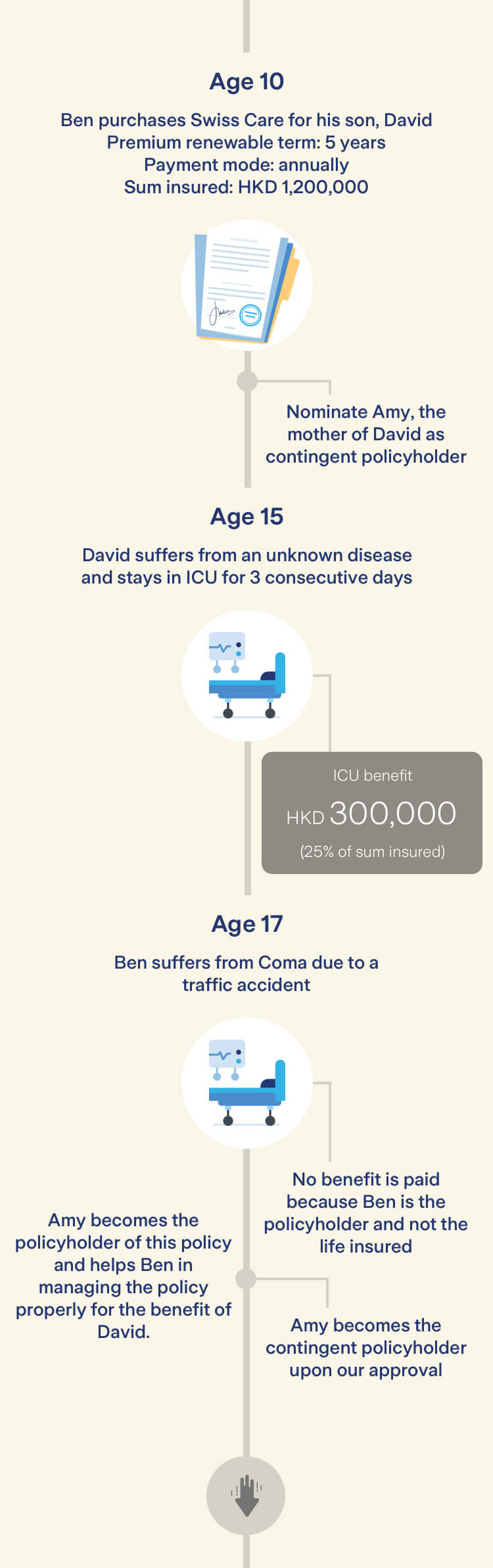

Policyholder: Ben Chan/Married with one child

Life insured: David Chan/Age 10

Ben is a loving father. He purchases Swiss Care for his son, he acts as the policyholder of the policy and nominates his wife Amy the contingent policyholder. This way he knows if he suffers from a specified disability, his wife can help him manage the policy for his son.

- The above example is hypothetical and is for illustrative purpose only.

- The age referred to in above example is the age of the life insured on his next birthday.